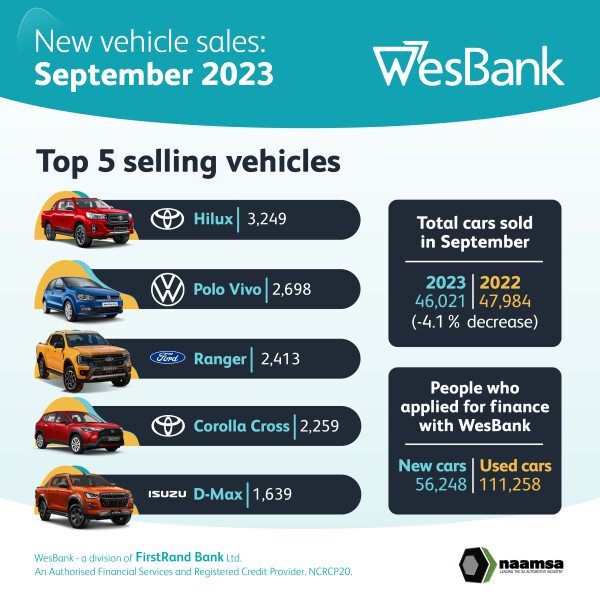

Consumer uncertainty and economic headwinds have cast a shadow over the South African automotive industry, as new vehicle sales experienced their second consecutive month of year-on-year declines. Data released by naamsa | the Automotive Business Council reveals that in September, South Africa’s new vehicle sales dropped by 4.1% to 46,021 units, marking the most substantial decline in market performance since December 2021.

Lebo Gaoaketse, Head of Marketing and Communication at WesBank, highlights the significance of this decline, saying, “September sales show the biggest decline in market performance year-on-year since December 2021. However, comparisons remain theoretical given the market’s prolonged recovery from the pandemic, and a broader context and assessment are necessary for a more realistic view of activity and sentiment.”

This downturn comes on the heels of August, which witnessed a 3.1% year-on-year decline in sales, signaling the first potential signs of strain in the industry since before the pandemic. Gaoaketse observes, “The fact that there are now two consecutive months of strain, with September appearing more severe than August, raises concerns for new vehicle sales. But it’s the trend that is concerning, not just the raw numbers.”

A closer look at September’s sales performance reveals a minor increase in sales volume (294 units) compared to the previous month, despite the steeper year-on-year decline. In August, sales demonstrated an even more significant month-on-month gain of over 2,000 units, even as year-on-year sales decreased.

“While the data indicates two months of negative growth, a market size of 46,000 units aligns with 2019 volumes,” Gaoaketse explains. “This suggests continued resilience and a gradual recovery in the wake of the pandemic. Although the market faces significant challenges, new vehicle sales continue to show resilience against the odds.”

The passenger car segment continued to lose market share, with September sales declining by 8.4% to 29,669 units. In contrast, Light Commercial Vehicles maintained their appeal, recording a 4.6% increase with 13,169 sales.

These consecutive months of decline have tempered year-to-date sales, which are now down 2.5% compared to the first nine months of the previous year. However, the market has surpassed the 400,000-unit mark, with total sales for the year reaching 401,315 units, compared to 391,500 units sold by the end of September 2022.

“The relief in September from further interest rate hikes will be welcomed by households with tight budgets,” Gaoaketse concludes. “However, other economic pressures stemming from fuel prices, inflation, restricted income growth, and the energy crisis will continue to influence consumer and business confidence and sentiment when making new vehicle purchase decisions.”

Featured image by Antoni Shkraba