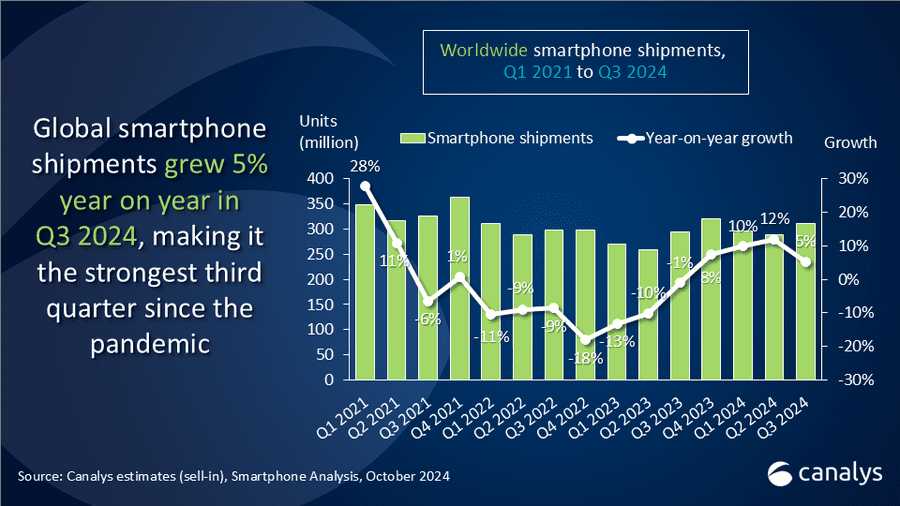

The global smartphone market has displayed remarkable resilience, with shipments climbing 5% year-on-year to reach 309.9 million units in Q3 2024, marking the strongest third-quarter performance since 2021.

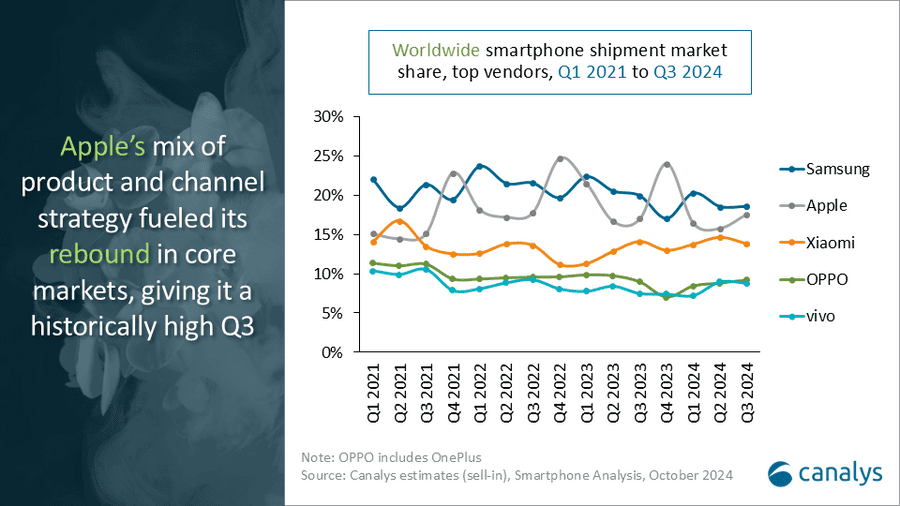

Samsung maintained its market leadership, shipping 57.5 million units despite a slight decline in market share to 19%. The South Korean giant’s success stems from a strategic streamlining of its entry-level portfolio, though this represents a 2% decrease from the previous year’s figures.

Apple secured second position with record Q3 shipments of 54.5 million units, achieving 9% growth. The American tech giant’s success was particularly noteworthy in emerging markets, where the iPhone 16 series benefited from reduced hardware disparities between base and Pro models.

“Apple achieved record Q3 shipments, driven by a strategic blend of channel and supply chain optimisations,” notes Canalys Analyst Le Xuan Chiew. “Post-WWDC’s Apple Intelligence announcements, consumers are actively upgrading from older iPhone 12 and 13 models to embrace this new technology.”

The competitive landscape remains vibrant, with Xiaomi holding steady in third place. The Chinese manufacturer shipped 42.8 million units, maintaining its 14% market share through calculated inventory management and strategic new product launches in its core markets.

| Global smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2024 | |||||

| Vendor | Q3 2024 shipments (million) | Q3 2024 market share | Q3 2023 shipments (million) | Q3 2023 market share | Annual growth |

| Samsung | 57.5 | 19% | 58.6 | 20% | -2% |

| Apple | 54.5 | 18% | 50.0 | 17% | 9% |

| Xiaomi | 42.8 | 14% | 41.5 | 14% | 3% |

| OPPO | 28.6 | 9% | 26.4 | 9% | 8% |

| vivo | 27.2 | 9% | 22.0 | 7% | 24% |

| Others | 99.4 | 32% | 95.9 | 33% | 4% |

| Total | 309.9 | 100% | 294.6 | 100% | 5% |

| Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. Source: Canalys Smartphone Analysis (sell-in shipments), October 2024 | |||||

OPPO and vivo rounded out the top five, shipping 28.6 million and 27.2 million units respectively. Vivo’s particularly impressive 24% year-on-year growth highlighted the intensifying competition in the Asia Pacific region.

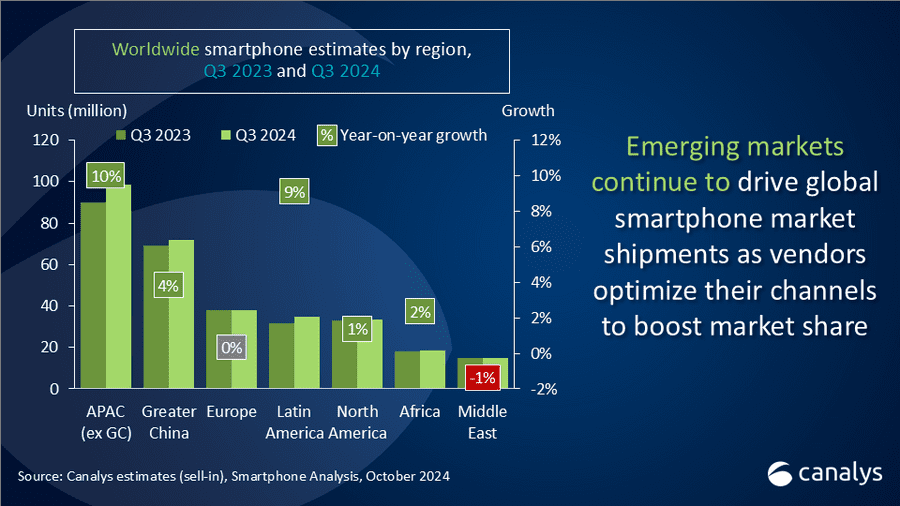

The market’s dynamics are shifting notably in emerging economies. Canalys Senior Analyst Toby Zhu points to OPPO’s success with its rebranded A3 series in the $100-to-$200 segment, particularly in Southeast Asia, where the company achieved 30% year-on-year growth.

However, the industry faces mounting challenges. Rising component costs and market saturation are pressing manufacturers to reconsider their mass-market strategies. In response, brands are increasingly targeting mid-tier growth in emerging markets, with Xiaomi leveraging its retail presence to boost sales of its Pro series.

Looking ahead, Canalys maintains cautious optimism. While emerging markets in Southeast Asia and Latin America outperform overall market expectations, mature markets like the US, China, and Western Europe are witnessing a different trend. In these regions, premium segment growth is increasingly driven by AI-powered differentiation, with manufacturers like vivo and HONOR expanding their mid-range portfolios through innovative retail strategies.

Featured image created by DALL-E