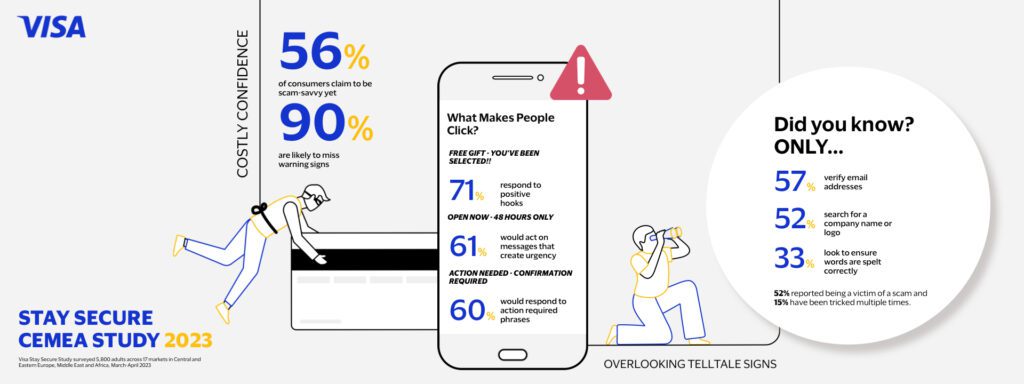

A recent study conducted by Visa has shed light on the growing threat of fraud among consumers in Central and Eastern Europe, the Middle East, and Africa (CEMEA). Despite an astonishing 56% of respondents considering themselves savvy in avoiding online and phone scams, the study reveals that a staggering 90% of these individuals are prone to overlooking common signs of fraudulent activity. This overconfidence in their ability to detect scams puts consumers at risk.

This research, spanning 17 countries, underscores the necessity for consumers to remain vigilant and attentive to the ever-evolving tactics employed by online criminals. Coinciding with Cybersecurity Awareness Month in October, Visa’s Stay Secure Campaign aims to raise awareness, enhance education, and instill the confidence needed to thwart social engineering threats effectively. The ultimate goal is to establish a secure and seamless digital payment landscape.

Visa’s Stay Secure Campaign offers consumers educational resources, including informative videos, easy-to-understand infographics, and practical tips. These tools equip individuals with the knowledge and skills to identify and prevent fraud attempts.

The study also revealed intriguing insights into consumer perceptions and experiences in various countries. Confidence in recognising scams and their associated vulnerabilities ranked highest in countries like Qatar (69%), Kenya (65%), South Africa (65%), Saudi Arabia (64%), and Nigeria (63%). However, the research indicated that a substantial number of adults in Kenya (74%), Nigeria (72%), and South Africa (64%) reported falling victim to scams or fraud, while Tunisia (43%) and Morocco (33%) had lower reporting rates.

Irene Auma, Head of Risk for Sub-Saharan Africa at Visa, commented, “In today’s digital-centric world, fraudsters are continuously developing more sophisticated tactics to deceive unsuspecting consumers. From fake parcel notifications to expired streaming subscriptions or free brand vouchers, scammers employ persuasive techniques to manipulate individuals. Understanding the language of fraud is now more crucial than ever, and our Visa Stay Secure educational platform equips consumers with the necessary knowledge and skills to stay ahead of online fraudulent activity.”

Key Findings of the Visa Stay Secure Study:

- The Knowledge Gap: Paradoxically, self-perceived knowledge about scams can lead to vulnerability. Those who consider themselves knowledgeable are more likely to respond to scammers’ requests, including positive news (74% to 67%) or urgent actions (65% to 55%).

- Concern for Others: While respondents express confidence in their own vigilance, over half (52%) are concerned that their friends or family might fall for scam emails offering free gift cards or products. Concerns also extend to children or minors (36%) and retired individuals (36%) becoming victims of online scams.

- Detecting Suspicion: Password requests are the most suspicious type of communication, with only 57% of respondents ensuring that communications are sent from a valid email address. Meanwhile, 52% check for the presence of the company name or logo, and fewer than half look for an order number (45%) or an account number (43%). Only 33% verify correct spelling.

Decoding The Language of Fraud

Scammers employ various tactics to craft messages that appear genuine and compel recipients to take immediate action. The Visa Stay Secure Study identified common patterns in scam language and how vulnerable respondents from surveyed countries are to these tactics.

- Orchestrating Urgency: Cybercriminals often create a sense of urgency to prompt action, such as clicking a link or responding to a sender. For instance, 40% of respondents admitted they would fall for messages about security risks, while notices from government entities or law enforcement agencies could deceive 36% of individuals.

- Sharing Positive News: Positive hooks in messages, such as “free gift,” “you’ve been selected,” or “you’re a winner,” can lead to action from 71% of respondents. Gen Zers are particularly susceptible to giveaways (39%), while 44% would click on a link or respond to a message offering a financial opportunity.

- Action Required: Phrases requiring action prompt responses from 60% of individuals, though requests to reset passwords trigger the highest suspicion.

Spot The Signs: Education and Awareness to Catch Scams in Action

Consumers can enhance their protection by adopting some simple but effective best practices:

- Keep personal account information confidential.

- Verify the legitimacy of links before clicking.

- Regularly monitor purchase alerts, which provide real-time notifications of account activity.

- Contact the number on corporate websites or the back of credit and debit cards when in doubt about the authenticity of a communication.

To access further insights from the 2023 Study and learn about the language of fraud, visit Visa’s Stay Secure web page.