YuLife, a tech-driven financial services provider that inspires life and turns financial products into a force for good, has announced its launch in South Africa. The London-based company achieved rapid traction in the UK insurance market with its flagship product, group life insurance. YuLife’s expansion into South Africa marks a significant milestone as it seeks to redefine how people around the world derive value from financial products.

YuLife’s group risk protection offers everything in a traditional group insurance policy, but it also adds a globally award-winning wellbeing app and trusted support services. The company harnesses the latest trends in behavioral science and game mechanics to encourage employees to make proactive lifestyle changes, while also prioritising prevention by de-risking individuals through healthy activities.

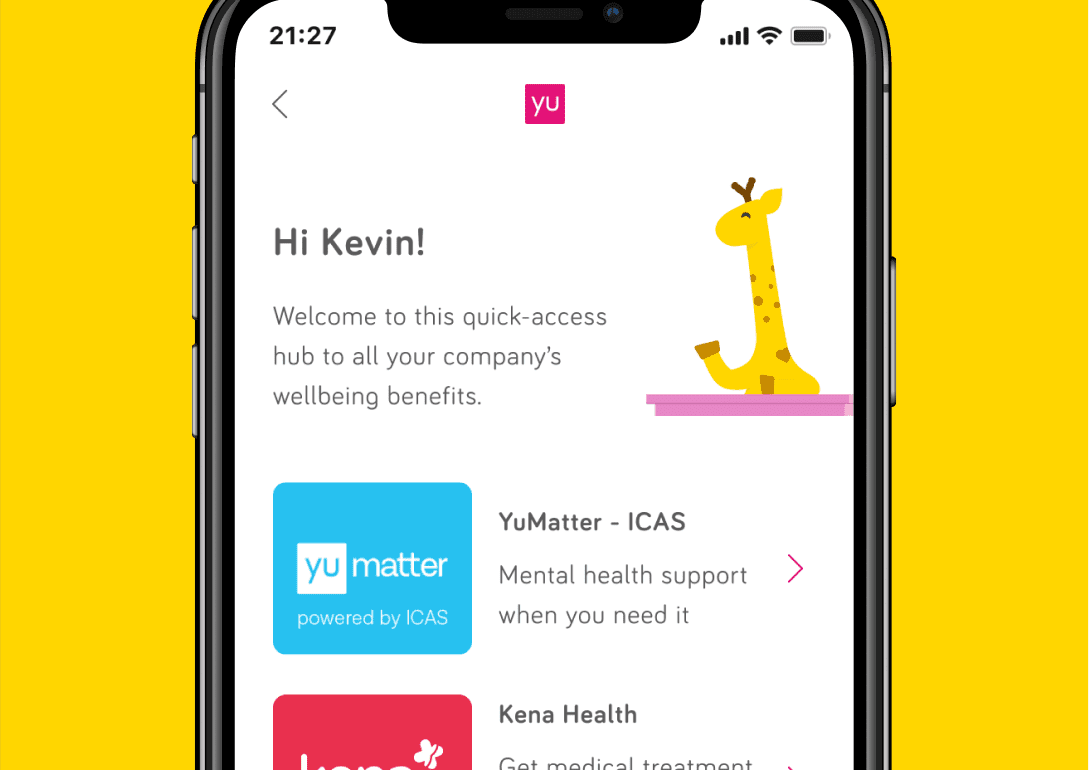

Gamification ensures that YuLife attracts unrivaled levels of engagement, which is valued and enjoyed by all employees. The YuLife app enables employees to complete everyday wellness activities, such as walking, meditation, and cycling, in order to earn YuCoin, YuLife’s virtual well-being currency. Members can then use their YuCoin to buy vouchers for groceries, data, fuel, clothing, and more from leading brands, or to improve the world by donating meals, planting trees, or cleaning the ocean. By incentivising healthy living, YuLife provides employers with a way to simultaneously boost retention rates, improve employees’ standard of living, and safeguard their loved ones’ financial future.

YuLife South Africa’s policies are underwritten by Guardrisk Life, SA’s largest life cell captive insurer and the market leader in tailored risk solutions. Herman Schoeman, CEO of Guardrisk Life, said that partnering with YuLife, a forward-thinking company that shares their commitment to meeting customers’ needs, makes good business sense.

YuLife has achieved rapid traction in an industry traditionally lacking in innovation. The company recently expanded into the US and now covers over 600k group policyholders across small to large businesses, with over $50bn of coverage in place. YuLife has seen more than 5x growth in premiums year-on-year, and in July 2022 raised a $120M Series C led by Dai-ichi Life with participation from T. Rowe Price, bringing the company’s total funding to $206M.