In a plot twist that would’ve seemed improbable a few years ago — back when “budget” phones meant plastic backs and sluggish processors — Apple has topped the global smartphone charts for Q1 2025. And no, it wasn’t the $1,799 Pro Max that did it. It was the iPhone 16e, Apple’s “budget” phone, which starts at a slightly too high $599 and delivers just enough Apple magic to feel aspirational… without obliterating your savings account.

According to Counterpoint Research, Apple edged out Samsung for the top spot in quarterly global shipments — the first time it’s ever pulled that off in a first quarter. The broader market grew 3% year-on-year, ending a two-year streak of decline. Cue the cautious optimism. But before we all start declaring the smartphone market “back,” it’s worth noting that this recovery may be less about consumer enthusiasm and more about supply chain timing, aggressive channel marketing, and, well, pent-up need.

The iPhone 16e has quietly become the device that makes Apple competitive in places like India, Brazil, and — increasingly — South Africa. It’s not revolutionary, but it’s practical, sleek, and carries that all-important Apple logo. In other words, it’s exactly what millions of people want right now: enough status to feel modern, and enough savings to feel smart.

A global recovery? Or just a mirage?

Let’s get one thing clear: a 3% growth in smartphone sales is nothing to sneeze at. But it’s also not a full-on resurgence. Yes, Q1 2025 was a marked improvement over the decline we’ve seen in recent years. But this wasn’t a sudden consumer awakening to the joys of new technology. Instead, analysts point to the factors we’ve become all too familiar with: strong sales in mature markets, while emerging economies remain skeptical at best.

The iPhone 16e’s success can’t be discounted. It’s what Apple has needed to crack the price-sensitive consumer segment in places where the latest iPhone still feels like an unattainable dream. By offering a more affordable alternative with a solid mix of features, Apple is positioning itself as an aspirational brand for the masses — without looking too out of reach. It’s like going to a party where everyone’s wearing suits, but you still manage to look chic in a smart blazer. It’s just enough.

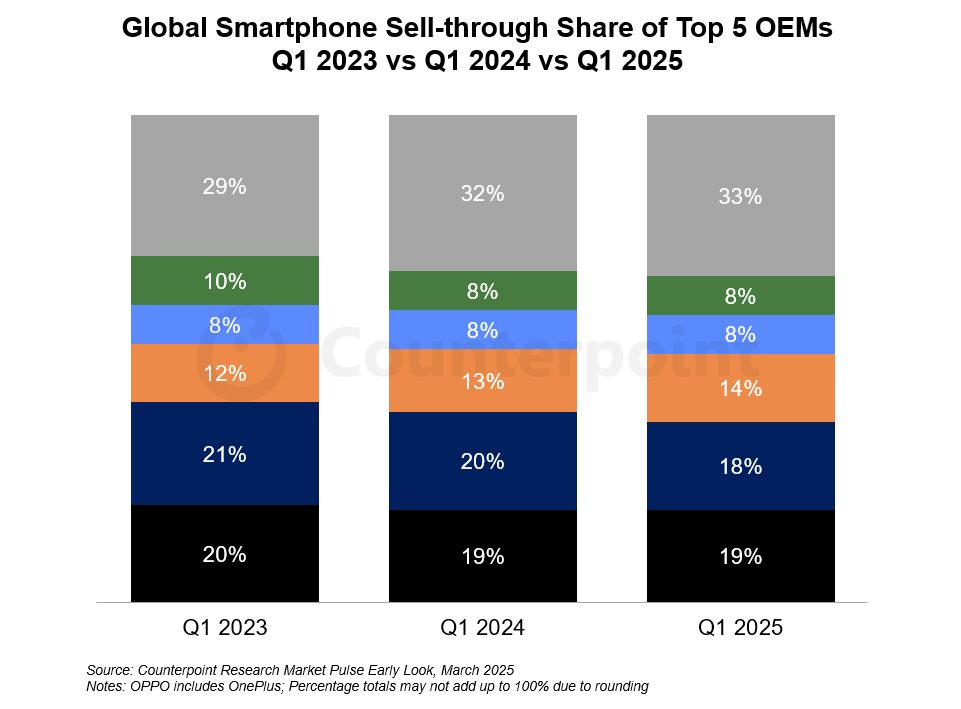

Apple now has a commanding 19% of the global market share, compared to Samsung’s 18%. It’s a feat that speaks to Apple’s ongoing battle with its South Korean rival, which has consistently dominated the smartphone category for years. The iPhone 16e, introduced as part of Apple’s larger effort to capture more affordable segments, may have been the magic bullet for now. But whether this growth is sustainable — or whether Apple’s reliance on lower-cost models could backfire — is another story entirely.

The iPhone 16e: Apple’s (not so secret) weapon

At $599, the iPhone 16e is the kind of device that makes you wonder how much of Apple’s “premium” reputation hinges on price tags rather than actual innovation. Yes, it has a decent camera, a beautiful display, and the solid build quality Apple fans expect, but it’s hardly the game-changing device we’re used to seeing from Apple’s top-tier models. It’s more like an answer to the question, “Can we make an iPhone that sells to more people without alienating the premium buyers?” And, to Apple’s credit, the answer seems to be a resounding “Yes.”

The real test will be whether this is a blip or the start of a deeper shift in strategy. The iPhone 16e is well-positioned for price-conscious buyers in emerging markets, where demand for smartphones with premium features but at a more accessible price is growing. But let’s not get too carried away. For all the excitement around this model, Apple still needs to navigate the broader global market challenges: inflation, geopolitical instability, and the ever-looming threat of an economic downturn that could put the brakes on any momentum.

What lies ahead?

While Apple may have clinched the top spot in Q1 2025, there’s still reason to temper expectations. The global smartphone market has been navigating an era of uncertainty — from shifting trade policies to fluctuating currency exchange rates. Yes, Apple has capitalised on the current moment, but there’s no guarantee that this success will extend throughout the year.

Samsung remains a formidable competitor, particularly in markets where Apple is still seen as a luxury brand. Meanwhile, Chinese brands continue to gain ground in the mid-range segment, offering better specs for less money. Even if Apple has conquered Q1, it will need to keep pushing innovation and differentiating itself from the pack.

The iPhone 16e’s success is a good start. But the smartphone market is a fickle beast, and Apple will need more than a solid budget phone to stay on top.